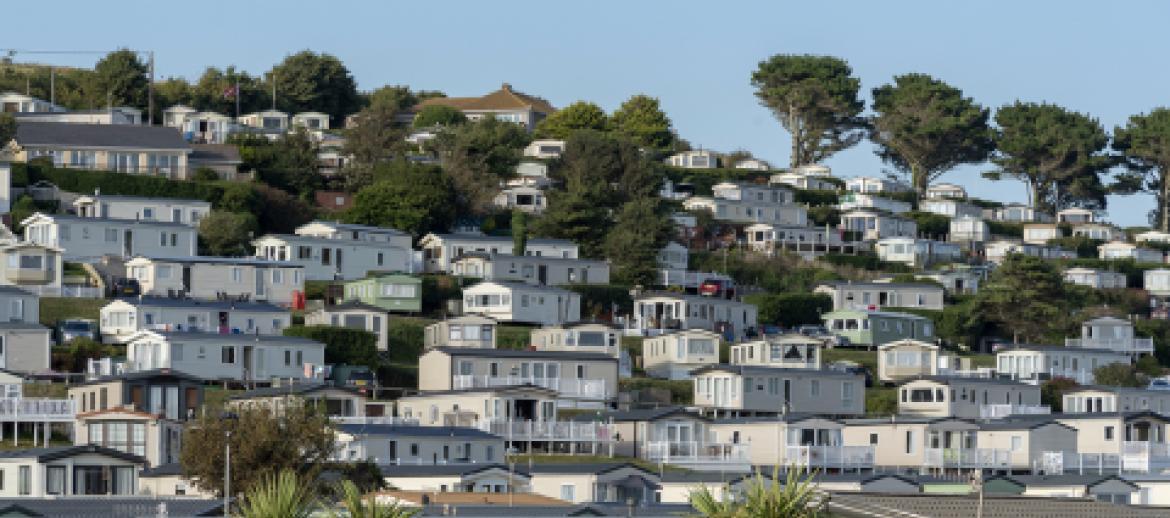

Case Study: Restructuring of a caravan park business

We have advised a number of parks on how they can benefit from a corporate relief that allows groups of companies, if they meet certain conditions, to dispose of one park through a limited company, and not pay Capital Gain Tax on the corporate disposal.

This meant we needed to review the current structure of the business and bring the various parks together into a group of companies. This has many advantages, especially around moving assets around the group of companies, as well as allowing losses to moved between companies rather than simply being carried forward. This restructure mean that those parks held in the separate limited companies could, if they had been subsidiary companies of the group for a period of time, to be disposed of free of CGT by the holding company. If say the park, held through a company, was disposed of for £1 million, meet the various conditions required to obtain the CGT and SDLT reliefs then the disposal would be tax free rather than suffering tax at #190,000, allowing further investment by the group of companies into new parks or attractions.

We were also able to review the remuneration paid to the directors and senior staff and make suggestions and changes that reduced the tax burden of the overall business, whilst link those senior staff members to key performance indicators that would drive further value into the business.

Learn more

Visit our Caravan and Lodges page to learn more about the services we provide.