There are no two people or businesses which are the same. Whilst there may be many similarities, just like people, each situation is unique.

There is now an ever increasing range of financial planning solutions available and information can be accessed far more easily with just the touch of a button.

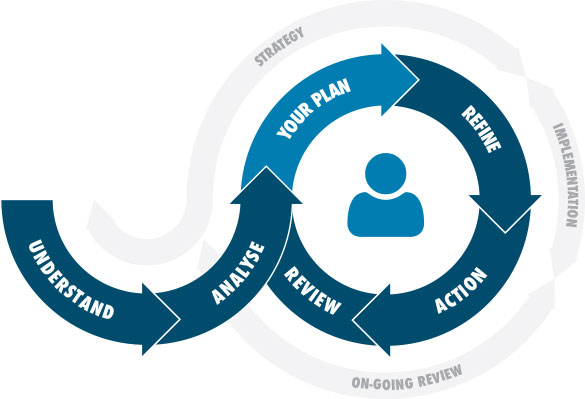

So how do you identify what the right strategy is for you? This is where we can work with you, as your independent financial adviser to ensure that you have a plan focussed on achieving your goals and aspirations.

Understand You

We will meet with you in order to understand your financial position and your goals and priorities.

Analyse

We will analyse the effectiveness of your current arrangements in light of your goals and identify any gaps and potential threats.

Your Plan

We will develop a personalised plan, recommending a specific course of action(s) that sets out how your goals can be achieved.

Refine

We will discuss with you our recommendations and listen to your views.

Action

We will implement the agreed plan.

Review

We will monitor the progress of your plan and make any changes necessary to ensure you are still on track to achieve your goals.

How we charge for our advice

We would normally arrange an initial meeting (for which we will not charge) in order to establish your needs and objectives. This allows our Financial Planning Consultants to make an assessment of the work to be undertaken together with any ongoing work that may be required and also provides you with the opportunity to ensure that you are comfortable working with us. You can read more about us here or in this brochure.

We will explain what costs will be payable for our advice and services but we will not charge you until we have agreed with you how much and how we are to be paid.

The steps involved in our advice process fall into three distinct areas as detailed below:

Strategy

We will consider your initial strategy and produce a report with our recommendations. This involves a full analysis of where you are now, what your objectives are, your attitude to risk and what actions we recommend you should take in order to achieve your objectives. An initial fee will be payable and agreed with you before we commence work, which takes into account the time and expertise involved in the analysis, together with production of the written report noting our recommended strategy.

Implementation

If you decide that you wish to proceed with our advice, we will arrange the implementation of the recommendations on your behalf. A fee will be payable for the work required in setting up the agreed plans including the arrangement of any investments or products on your behalf. This fee will, of course, have been agreed prior to commencement of the work involved.

Ongoing Review

We believe that most clients should review their strategy to ensure that once it has been implemented it stays on track. Assuming this is right for you, we will agree the frequency and types of reviews to meet with your requirements. We will agree an ongoing fee for regular reviews based upon their frequency and the work involved. You can read more about Our Ongoing Review Service in our brochure.

Typically we will charge a fixed amount for the strategy and implementation stages and a percentage charge for on-going reviews.

Would you prefer to hear what our clients say about working with us? Visit our Financial Planning & Wealth Management page to watch our videos.