MTD requirements of accounting software

All businesses will need to review their accounting software to ensure that it will be compliant with the new regime. As a minimum, it will need to be able to:

- Process records in a digital form

- Preserve digital records in a digital form

- Create a VAT return from the digital records

- Provide HMRC with VAT data on a voluntary basis

- Receive information from HMRC via the API platform in order to allow HMRC to send ‘nudges’ to the firm or their tax agent

For advice about accounting software or digital record keeping get in touch.

Contact usDigital record keeping requirements

HMRC has confirmed businesses do not need to keep digital invoices and receipts, however, they do need to keep the transaction data digitally. The list below summarises what is required to be kept digitally:

Designatory data

- Your business name

- The address of your principal place of business

- Your VAT registration number

- A record of any VAT accounting schemes that you use

For each supply you make you must record

- The time of supply

- The value of the supply

- The rate of VAT charged

For each supply you receive you must record

- The time of supply

- The value of the supply including any VAT that is not claimable by you

- The amount of input tax that you will claim

Our Solutions

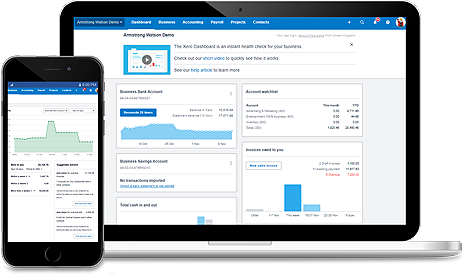

Armstrong Watson has been working towards an MTD solution for the last two years and we are ready to help all clients get compliant. Our innovative approach allows us to do this as quickly and as efficiently as possible resulting in two main solutions:

Armstrong Watson Assisted simply provides us with a digital bank feed (Very easy to set up) and we can cost effectively take care of your MTD needs in the way we have helped clients prepare VAT returns in the past.

Armstrong Watson Xero Training allows you to gain access to our our 8 year Xero experience to help you set up your own digital accounting system, enabling you to take care of your MTD requirements.

Get in touch for more details

Get in touch with our team